PrimeXBT Bitcoin Prediction Insights and Future Trends

PrimeXBT Bitcoin Prediction: Insights into the Future of Cryptocurrency

The world of cryptocurrency is constantly evolving, with Bitcoin (BTC) remaining at the forefront of this transformation. As investors and traders seek to gain an edge, platforms like PrimeXBT are becoming essential tools for predicting Bitcoin’s future price movements. In this article, we will explore various factors affecting Bitcoin prices, analytical techniques used for predictions, and what the future might hold for this leading cryptocurrency. For a deeper understanding and up-to-date insights, you can check out the trading signals offered by PrimeXBT primexbt bitcoin prediction https://primexbtforex.com/signals/.

Understanding Bitcoin: A Brief Overview

Bitcoin was created in 2009 by an individual or group of individuals using the pseudonym Satoshi Nakamoto. It introduced a decentralized currency not controlled by any government or central authority, allowing for peer-to-peer transactions over the Internet. Bitcoin operates on blockchain technology, which ensures transparency and security.

Since its inception, Bitcoin has garnered significant attention from both investors and the media, often regarded as digital gold. Its finite supply of 21 million coins has created a sense of scarcity, contributing to its value. Over the years, Bitcoin has experienced extreme volatility, driven by various market dynamics.

Factors Influencing Bitcoin Prices

To predict Bitcoin’s future prices effectively, it’s crucial to understand the various factors that influence its price fluctuations. Here are some key determinants:

1. Market Demand and Supply

The most fundamental economic principle affecting Bitcoin prices is the balance between demand and supply. When demand for Bitcoin increases, particularly during bullish markets, prices tend to rise. Conversely, in bearish markets with low demand, prices may drop.

2. Regulatory Developments

Government regulations can have a profound impact on Bitcoin’s price. Positive regulatory news can boost investor confidence, while stringent regulations can lead to market downturns. Countries around the world are still grappling with how to classify and regulate cryptocurrencies, which adds an element of uncertainty.

3. Market Sentiment

Bitcoin’s price is also influenced by overall market sentiment. News events, social media trends, and public opinions can swing market sentiment in favor of or against Bitcoin, sharply affecting its price. Traders often rely on sentiment analysis to gauge market mood.

4. Technological Advances

Technological improvements in the Bitcoin ecosystem can also play a crucial role in its price prediction. Major updates like the Bitcoin halving, which occurs approximately every four years and reduces the mining reward, can lead to increased scarcity and subsequently impact prices.

5. Competition from Other Cryptocurrencies

As new cryptocurrencies emerge, competition for market share can influence Bitcoin’s price dynamics. Investors may allocate funds to emerging altcoins, which can lead to volatility in Bitcoin’s value.

Analytical Techniques for Bitcoin Predictions

Predicting Bitcoin’s future price involves a blend of technical analysis, fundamental analysis, and market sentiment evaluation. Let’s break these down:

1. Technical Analysis

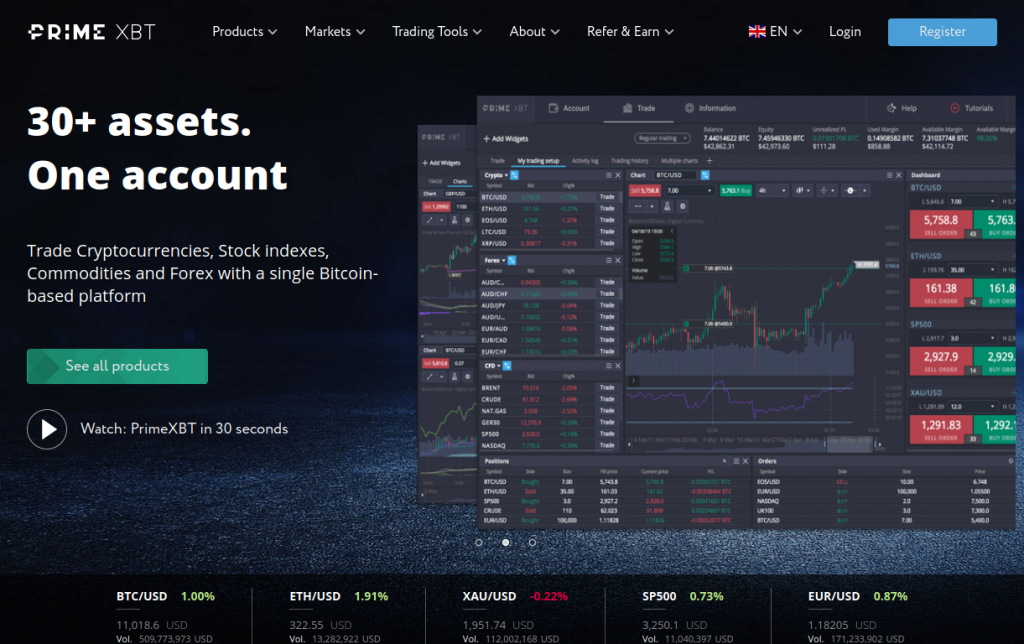

Technical analysis (TA) employs historical price and volume data to forecast future price movements. Traders often use various chart patterns, indicators like the Moving Average Convergence Divergence (MACD), and support/resistance levels to predict price action. Popular tools available on PrimeXBT enable traders to conduct detailed technical analyses.

2. Fundamental Analysis

Fundamental analysis (FA) evaluates external factors that could influence Bitcoin’s price, such as economic indicators, adoption rates, and market news. For instance, tracking the number of companies accepting Bitcoin or analyzing macroeconomic trends can provide insights into potential price movements.

3. Sentiment Analysis

Sentiment analysis involves gauging public sentiment toward Bitcoin through social media, news articles, and online forums. Tools that aggregate sentiment data can provide a broader view of market psychology, helping traders anticipate price movements based on collective investor behavior.

Future Trends and Predictions for Bitcoin

Given the volatile nature of Bitcoin and the complexities of its market, predictions can often vary significantly. However, several trends have emerged that could shape Bitcoin’s future:

1. Increased Institutional Adoption

As financial institutions and major corporations increasingly adopt Bitcoin as a legitimate asset class, this could lead to greater demand, potentially driving up prices. Companies investing in Bitcoin treasuries are indicative of this trend.

2. Innovations in Blockchain Technology

Further advancements in blockchain technology could enhance Bitcoin’s functionality and scalability, thereby attracting more users and investors. Upgrades like the Lightning Network aim to improve transaction speeds and reduce costs, which can foster adoption.

3. Regulatory Clarity

As regulation surrounding cryptocurrencies becomes clearer, it could pave the way for more conservative investors to enter the market. This influx could lead to greater stability and potential price increases.

4. Bitcoin and Digital Currency Integration

The rise of central bank digital currencies (CBDCs) could coexist with Bitcoin, leading to new use cases and possibly increasing Bitcoin’s legitimacy as an alternative currency.

Conclusion

As we look to the future, Bitcoin’s trajectory remains an intriguing subject for traders, analysts, and investors alike. While predicting exact prices can be fraught with uncertainty, understanding the market’s dynamics through platforms like PrimeXBT can provide valuable insights. With continuous evolution in technology, changing regulations, and market sentiment, the cryptocurrency landscape will undoubtedly continue to transform. Staying informed and adapting to these changes will be key for those keen on trading Bitcoin successfully.

In summary, while there are no guarantees in trading or investing in Bitcoin, employing various analytical techniques can enhance your understanding and improve your decision-making process. As always, it’s essential to conduct thorough research and consider multiple factors before making investment decisions in this dynamic market.